Hello, and welcome to the monthly market report for February 2022. My name is Cory Harter. I’m with Homes by Chris Harter and eXp Realty.

Today I’m going to be walking you through one of the most important topics in the housing market right now. We’ll be talking about homeownership as a hedge against inflation. Now, why is this important for us to be talking about? Well as we see prices rise around us at the gas pump, at the grocery store, homeownership is certainly not immune to that in any way. Neither is rent, it’s rising also. So we’re going to talk about that as well. But one of the things we want to focus on is how locking in someone’s fixed monthly costs, the biggest cost that they have in homeownership, that today’s price is so beneficial to safeguarding someone and hedging against that inflation and that rising cost around us going forward.

I want to begin with a quote, it’s from Investopedia. It says, “Real estate is one of the time-honored inflation hedges. It’s a tangible asset, that those tend to hold their value when inflation reigns, unlike paper assets. More specifically, as prices rise, so do property values.” So what can we see here is that homeownership is one of those things that can lock in the cost today. It’s an asset that is increasing in time. And as prices rise home value rises and that prices all around us rise. And you know that locking in that fixed cost in ownership is really game changes the hedge against inflation for tomorrow.

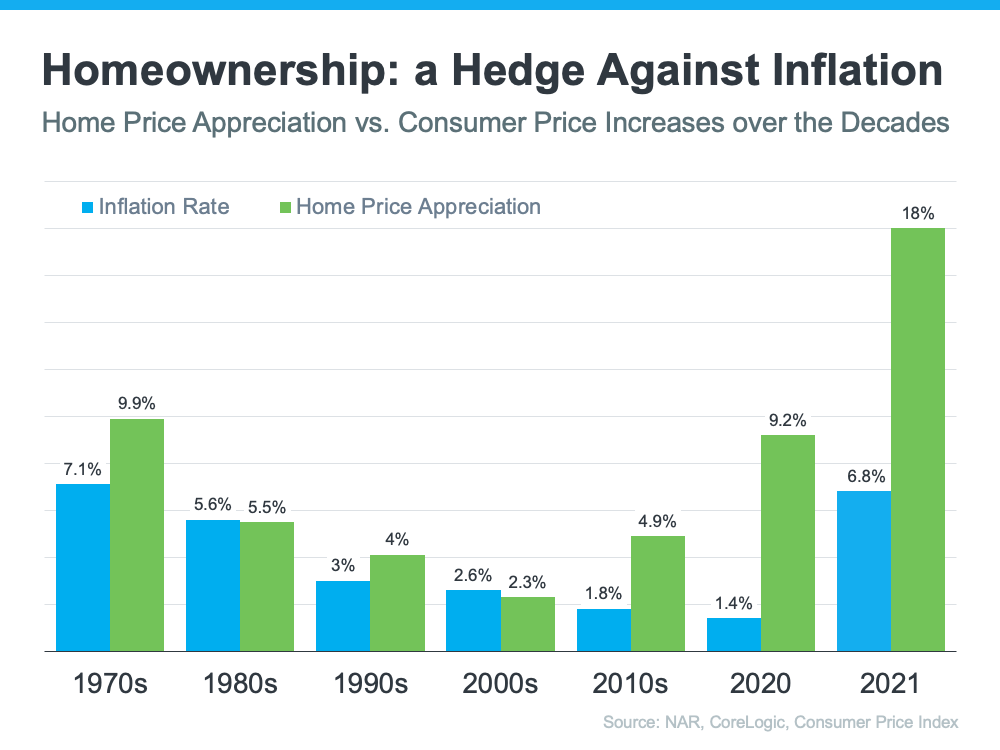

So what I want to do on the next slide is to show you a visual that really depicts what we’re talking about homeownership outperforming inflation over time. So let’s take a look at this slide. This is homeownership as a hedge against inflation. And I want to break it down for you so you can really, really see what we’re talking about here. This is a home price appreciation versus consumer price increases over the decades. Then it goes all the way back to the 1970s. Now, what you’re looking at here is the blue bars, they’re the average inflation rate for the decade and the green bars are the average home price appreciation for each of those decades as well. Let’s look at the 1970s to start. Inflation increased 7.1% in that decade and home values appreciated at 9.9% in the same time period. Pretty good. Right? So homeownership outperformed inflation. And where do you want to be in inflationary time? In that asset that’s outperforming inflation, right? That’s where we were at then.

Now in the eighties, it was a little bit more balanced, 5.6% inflation you can see versus 5.5% home price appreciation. The nineties, we start to see home values tick up a little bit more, outperforming inflation throughout the decade. And then you know about the 2000s were very different. Home prices outperformed at a very different rate than what we’ve seen in many other decades. And even what we’re seeing today and potentially tomorrow. So we had a fundamentally different housing market. We had an oversupply of homes, the lending standards were also vastly different than they are today. Homeowners didn’t have the equity in their houses that they have right now. So fundamentally a different market. And that’s not where we’re going to be heading now moving forward. So home prices did not outperform inflation in the 2000s but look at the 2010s. This is where home values really started to kick in. Homes started appreciating much faster than inflation, 4.9% versus 1.8.

And then you had the 2020, 2021. And you know what happened there, massive home appreciation. There’s a drastic difference where home values outperformed inflation. So over time, what you can see is that homeownership is generally looked at as this great hedge against inflation because home values are outperforming better than the inflation rate. That means someone buying a home today can lock in today’s costs and protect themselves against the rising cost of inflation and that biggest monthly payment that they have going forward. Now, this becomes really important when we start to talk about renting because renting takes on the risk of rising rental prices year after year. We’ve shown you that data in the past. And if you’ve been following along with us, rental prices are truly skyrocketing.

So let me share a quote here that’s really powerful for renters. Well, this is from Bankrate. It says, “A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. I mean, property taxes are going to rise. Other expenses may creep up, but your monthly housing payment remains the same.” That’s certainly not the case if you’re renting. And that’s because rental prices rise year after year. And so this becomes really powerful for someone who might be sitting here going, “I could buy today, but I’m going to just kind of press pause and I’m going to wait. I’m going to see what happens with those home values and if they drop or if they rise.” Well, I can tell you all the forecasts that we’ve seen show that home values are projected to continue rising. We also know that mortgage rates are projected to keep rising and we know that rental prices are rising. So what does that mean at the end of the day, someone who continues to rent, but could buy, is taking on additional increases in rent year after year.

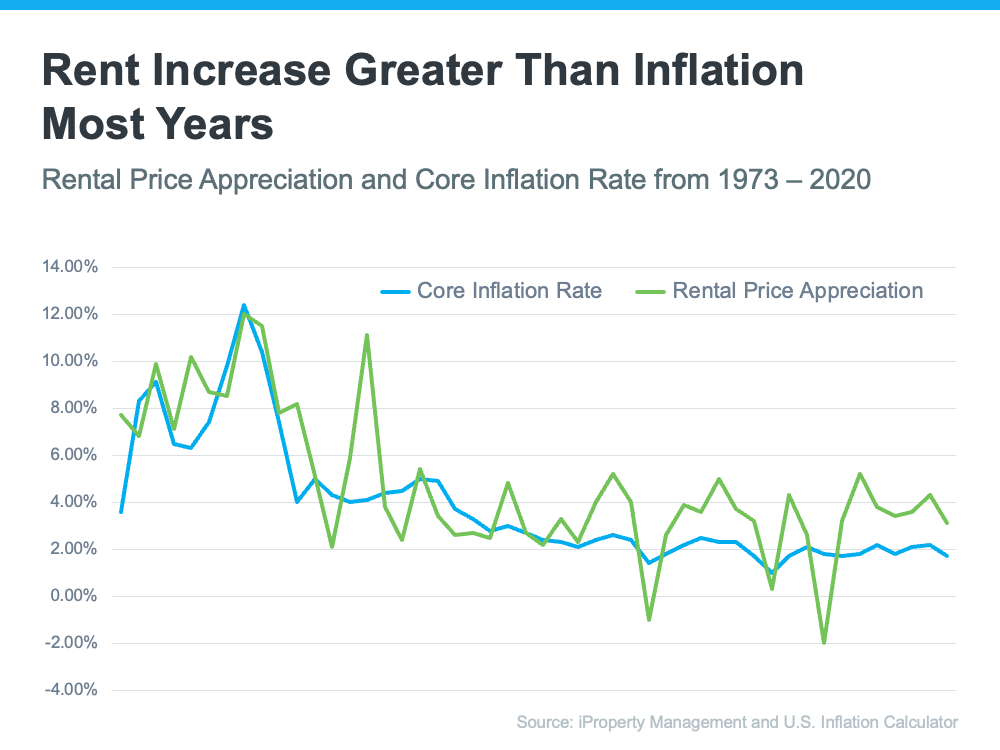

Plus it’s going to cost more to buy a home down the road. So really important for renters to understand this dynamic. And I think this next visual will really help show how rental prices compare to the inflation rate. This shows that rent has been greater than inflation in most years. So let’s break it down again. Rental price appreciation versus core inflation rate, again, going all the way back to the seventies. So your blue line here, is that core inflation rate and your green line is the rental price appreciation. And what do we see on a whole? Well, the green line is higher than the blue line in most scenarios, meaning the rental prices have increased at a faster rate than inflation in most times. And yes, there are some ticks down below that blue line, but that just means it’s … However, if you look at the overall graph, it means that it’s more expensive to rent over time because rental prices are continuing to rise faster than the inflation rate.

So when we have this conversation with renters, it becomes mission-critical that they understand the dynamic of buying now, if they can avoid those increased costs for rent and inflation all around us. So let me go ahead and share this quote. This really kind of brings it home for all of us, I think. This is out of Forbes. They said that, “Homeowners are shielded for mounting rental prices because their cost is fixed, regardless of what happens in the market. They’re locking in that payment at today’s costs. Tangible assets like real estate, get more valuable over time.” You see that in the data and the graphs that we’ve shown you, which makes buying a home a good way to spend your money during inflationary times.

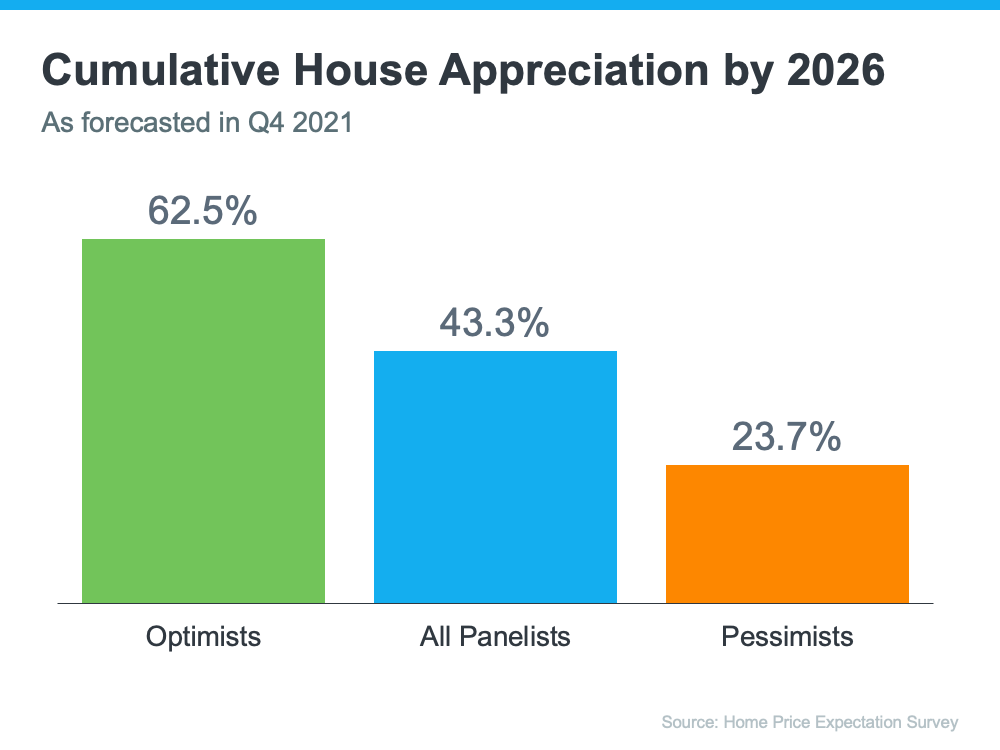

We’ve talked a lot about home price appreciation, and I’m sure you want to know where that is headed. And as we have this conversation and we think about rising prices and how homes aren’t immune to that. That’s for certain. So let’s take a look at this next graph. It’s the Home Price Expectations Survey. And I think it gives you a real clear picture where home prices are projected according to the experts. Now, the Home Price Expectations Survey is a survey of a hundred economists, data analysts, people who are projecting out home price appreciation. And in the fourth quarter of last year, this is a projection for cumulative house appreciation by 2026. So what are we looking at? They divided out the group into optimists and pessimists. Optimists, obviously being the ones projecting the most appreciation over the next five years and pessimists estimating on the lower side.

So let’s take a look here. You can see that three out of the seven, that orange bar, those are the pessimists. You know, that the experts that are saying home price appreciation on the lower side, cumulatively, they’re saying by 2026, the appreciation is going to be over 23%. Those are the pessimists. So that’s still really, really good growth. So the message, experts look forward, the conditions of the market, what’s projected to happen. Home values are expected to increase in value over time. Even on the lower end, I mean 23%, that’s pretty significant over the next five years. So locking in today’s cost is very critical for those of you to have the opportunity to do so to protect yourself against your largest monthly payment is also important. So as we move forward with home prices rising, mortgage rates rising, inflation’s all around us. It’s going to get more expensive to purchase a home, just the way it is.

I hope this gives you guys a better look at the housing market as we move forward. If you have any questions, please reach out to us. It’s very important that you have a handle on this housing market to make sure that you understand what the outcomes will be, whether you’re selling, buying, or investing in real estate today. Feel free to DM, call, or email us anytime. If you like what you heard today, if you could please press the like button below. Pass it on to anybody that you feel might be able to benefit from this information. And I really appreciate your time. Have a great day.